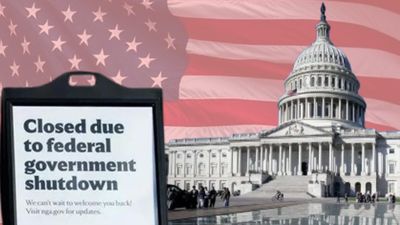

31 days and counting: Over $7 billion wiped out; how US govt shutdown is hitting the American economy

The United States is nearing the longest federal government shutdown in history, having remained closed for the entire month with no resolution in sight. Economists have warned that the longer the impasse drags on, the greater the risk that the economy, already showing signs of strain, could shift from bending to breaking.“The economy is fragile and, therefore, something like a government shutdown could become a bigger problem a lot faster than people might think,” said Mark Zandi, chief economist at Moody’s Analytics, as quoted by CNN.Fresh estimates released this week by the Congressional Budget Office (CBO) show the shutdown has already shaved off at least $7 billion in economic output permanently. Furthermore, the economic damage will rise the longer the shutdown continues, with losses reaching $11 billion after six weeks, and $14 billion if it stretches to eight weeks.Diane Swonk, chief economist at KPMG, compared the cascading effects to a snowball gathering mass, “That’s kind of like a snowball rolling down a hill, gathering momentum and mass.”

‘Not creating any jobs’

The shutdown comes on top of an already weak labour market, defined by low hiring, low firing and minimal movement. Employers have been delaying investments and staffing decisions because of financial and policy uncertainty, while some companies have begun testing artificial intelligence and automation, resulting in mass layoffs.“We’re not creating any jobs of consequence, really,” Zandi said.As the job market is already weak, the small number of jobs being added could turn into actual job losses. If government support systems weaken, federal workers miss paychecks, and people spend less money, businesses might start firing workers or closing down.

No payments? Small businesses at risk

A report by the US Chamber of Commerce cited by CNN suggested that 65,500 small business contractors have $12 billion worth of payments at risk this month due to paused government operations.Nicole Bachaud, labour economist at ZipRecruiter, said that the interest rate cuts and trade clarity were expected to boost hiring in 2026 and that momentum could be derailed. “However, tariffs are projected to dampen consumer spending before year’s end, and a prolonged shutdown could further erode consumer confidence,” she wrote. The Conference Board’s latest index reflects that trend, showing consumer sentiment at its lowest level since April.

Healthcare might take a hit

The political deadlock hinges on the expiry of enhanced subsidies under the Affordable Care Act. Democrats insist the funding bill must extend the subsidies; Republicans refuse to discuss it until the government reopens.Open enrollment begins 1 November, and without renewed subsidies, 22 million Americans using the federal marketplace could see premiums spike by 26% on average, according to a KFF analysis, quoted by CNN.That same day, more than 65,000 children and families in 41 states and Puerto Rico risk losing access to Head Start early education programmes. Temporary closures would add financial pressure on low-income households and lead to immediate childcare disruptions, a factor known to weigh on workforce participation, particularly for women.

‘Things start to break’ — If that spending does not occur!

Economists warn that delayed or cancelled spending, job hires, travel, even holiday shopping, may not return later.“And this isn’t economic activity that is just deferred or delayed, you’re now creating a condition of economic activity that just simply doesn’t happen,” said Joe Brusuelas, RSM US chief economist.Zandi added that the broader economy reaches a critical stage when confidence begins to crack, “When this thing really metastasizes and takes out the broader economy is when it starts to affect confidence – consumer, business, investor confidence – the stock market takes notice and instead of going straight up, it starts to wobble and starts going down.” If the shutdown stretches beyond Thanksgiving, he warned, “there’s no coming back from that quickly.”A prolonged stalemate may also influence inflation and interest rate decisions. Disruptions could push some prices higher, but weaker demand could pull inflation lower. “The net of all that, I think, is hard to know,” Zandi told CNN, noting the Federal Reserve may feel more pressure to continue cutting rates as the job market suffers. “The Fed’s putting a higher weight at this point on the weak job market than they are on inflation or financial conditions.” He further added that this shutdown would weaken the already fragile job market more.

Americans on the edge

Millions relying on federal aid programmes, including food assistance under SNAP, face increasing uncertainty. For many households already struggling with inflation, any delay in government support could deepen hardship. Zandi said that majority of the Americans are “not taking any solace from the fact that AI stocks are going stratospheric; they’re focused on having to make their credit card payment or the student loan monthly payment.’”“It just adds insult to injury on an economy that was already showing some cracks,” Swonk said, adding, “Low- and middle-income households are really struggling, and inequality tends to stoke political divisions as well as political backlash. So, this is just feeding in to already a not very comfortable situation that we are in.”“It’s hard when you see the struggles we’re already facing, but this is a man-made problem,” she said.

No breakthrough in Capitol Hill

The shutdown entered October after Congress failed yet again to agree on a temporary funding bill. The House passed a measure on 19 September to keep the government open until 21 November, but it stalled immediately in the Republican-controlled Senate.It is now the second-longest shutdown in US history, just days short of the 34-day standoff of 2018–2019.

A look at the numbers

- 670,000+ furloughed workers: According to the Bipartisan Policy Center, these workers are off the job without pay. The CBO estimates furloughed compensation costs at roughly $400 million a day.

- 730,000 working without pay: According to CBS News, these “essential” federal staff continue working despite receiving no wages.

4,000 federal workers facing layoffs: A federal judge has temporarily blocked the administration’s attempt to fire thousands during the shutdown. - $130 million private donation: President

Trump said that a private donor, identified by media reports as billionaireTimothy Mellon , provided funds to maintain military pay, CBS News reported. - Up to $14 billion economic loss: The CBO warns that a shutdown lasting eight weeks or more would permanently erase $14 billion from GDP.