Billionaire Ray Dalio thinks American economy is dependent on the 1%; with only three states driving its GDP | Business

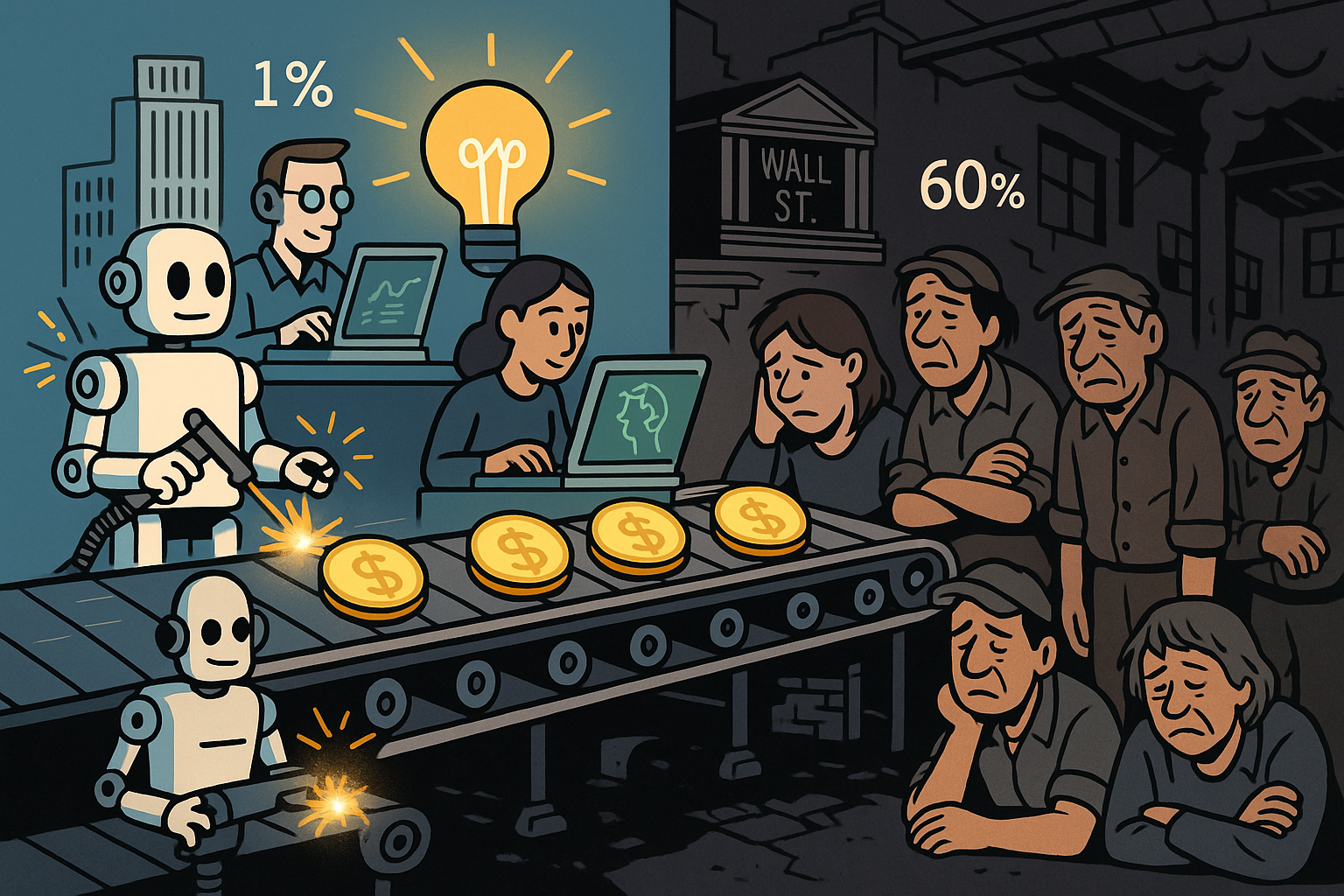

The American economy may look healthy on paper. Wall Street is roaring, Silicon Valley is buzzing with AI optimism, unemployment is steady, and GDP is rising. But billionaire investor Ray Dalio says this apparent prosperity hides a deeper imbalance. The US, he argues, is becoming dangerously dependent on a small, highly productive elite, while the majority of its workers are falling behind.

Driving the News

Speaking at the Fortune Global Forum in Riyadh, the Bridgewater Associates founder said the US economy can no longer be viewed “as a whole.” “You have to look at everything in terms of the very, very big differences and how those differences are handled,” Dalio said. He explained that about 1% of Americans — roughly three million people — are leading in areas like AI and technology, with another 5–10% around them forming the productive core. “The rest — the bottom 60% — are struggling,” he added, pointing to low literacy and declining productivity as warning signs.

The Divide in Numbers

Dalio’s remarks echo new research from Moody’s, which found that 22 US states are in recession, while 13 are stagnant and only 16 are growing.Yet, the national numbers appear healthy because three states — California, Texas, and New York — are driving most of America’s GDP.As Moody’s chief economist Mark Zandi explained, California’s tech sector and New York’s financial power are propping up the entire system: “The future of the entire US economy is tied to the growth in two states.”Dalio also highlighted the deeper social implications: “Consider this, 60% of the American population has below sixth-grade reading level. That’s tough… and because of those things you have a dependency, an extreme dependency.”

A Growing Wealth Gap

- Data from the Federal Reserve show how sharply the wealth divide has grown:

- Between 2020 and 2025, the bottom 50% of Americans gained about $2 trillion in wealth.

- The top 0.1%, meanwhile, nearly doubled their assets from $12.17 trillion to $22.33 trillion.

Dalio says this poses a major policy challenge:“The question is what do [policymakers] do when you don’t have enough money and you have this big wealth gap?” He cautioned that redistributing wealth is a “very difficult decision” with serious consequences for productivity. His advice to leaders was to treat it as a mechanical, not ideological, issue: “What you have is a choice of who’s gonna pay and how are you going to do this?”

Why It Matters

Even consumer spending reflects the same imbalance. Moody’s found that top earners — those in the 96.6% to 100% bracket — have lifted their spending to 170 basis points compared with 1999 levels, while low and middle-income Americans are at around 120, barely keeping up with inflation. “The US economy is being largely powered by the well-to-do,” said Zandi. “As long as they keep spending, the economy should avoid recession, but if they turn more cautious, for whatever reason, the economy has a big problem.”

Why His Views Matter

Dalio is an American investor, hedge fund manager, author, and philanthropist best known as the founder of Bridgewater Associates, one of the world’s largest and most influential investment firms. Born in New York City in 1949, Dalio grew up in a middle-class household and developed an early fascination with markets, buying his first stock, Northeast Airlines, at the age of 12.After earning a degree from Long Island University and an MBA from Harvard Business School, he started Bridgewater in 1975 from his small apartment in New York. Over time, Bridgewater became a global powerhouse managing tens of billions of dollars for governments, pension funds, and institutions. Its flagship fund, the Pure Alpha Fund, gained fame for its consistent performance and for anticipating major economic events such as the 2008 financial crisis.Dalio’s reputation rests not only on his investing skill but also on his unique management philosophy. He introduced the idea of “radical transparency” at Bridgewater, a culture where employees are encouraged to question each other openly and where meetings are recorded to promote honesty and accountability. His book Principles: Life and Work presents these ideas, blending practical lessons with reflections on decision-making, leadership, and personal growth.Beyond finance, Dalio has become a leading commentator on global economics, debt cycles, and inequality. He frequently warns about the risks of widening wealth gaps and declining productivity, arguing that such divides can threaten social and political stability.In recent years, Dalio has stepped back from day-to-day management at Bridgewater to focus on mentoring, writing, and philanthropy. Through the Dalio Foundation, he supports education, ocean exploration, and mental health research. Today, he remains one of the most influential voices in economic thought and a figure whose career reflects discipline, curiosity, and an enduring search for truth.

Bottom Line

Ray Dalio’s message is clear: America’s economy has split into two worlds. One is led by a small group whose productivity and innovation sustain national growth. The other, much larger group, struggles with low literacy, weak income, and declining productivity. The risk, he warns, is not just inequality but dependence — a nation living off the output of its top 1%.