Easing trade tensions with Trump: India’s crude imports from US surge to highest since 2022; diversification away from Russian oil?

In a move that is possibly aimed at reducing trade issues with the Donald Trump administration, India has stepped up its crude oil imports from the US substantially. Crude imports in the month of October have hit 540,000 barrels per day till October 27 – a level which is the highest since 2022, as per Kpler data.According to a PTI report, the crude import numbers reflect India’s strategic initiative to expand its oil import sources beyond Russia whilst addressing trade-related concerns with the Trump administration.

Why is India stepping up US crude oil imports?

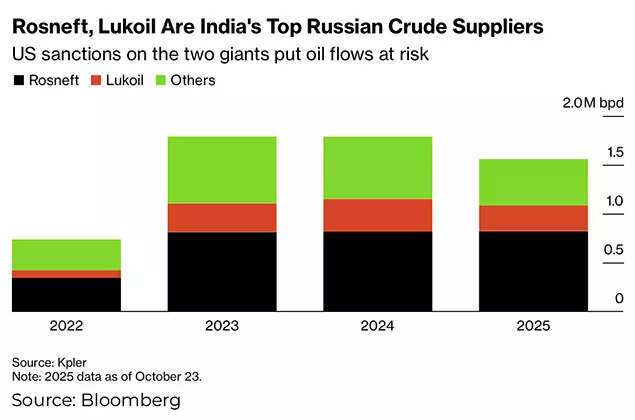

US crude oil imports to India surged due to economic factors, including a favourable arbitrage opportunity, an expanded Brent-WTI differential, and reduced Chinese purchasing, which made WTI Midland an attractive option for Indian refineries, as explained by Sumit Ritolia, Lead Research Analyst – Refining, Supply & Modelling at Kpler.Statistics quoted in the report indicate that October is expected to end with approximately 575,000 bpd, whilst November projections suggest volumes between 400,000-450,000 bpd, as per US export figures. This is a significant increase from the year-to-date average of roughly 300,000 bpd.Also Read | Trump hits bulls’s eye with US sanctions? Why India, China may stop buying Russian oil – explainedAccording to government and trade officials quoted in the report, Indian refiners have stepped up their procurement of US crude varieties, including Midland WTI and Mars, to broaden their supply sources and demonstrate collaboration with Washington. This strategic adjustment also comes at a time when Indian refiners navigate strengthening sanctions against Russian oil companies Rosneft and Lukoil.

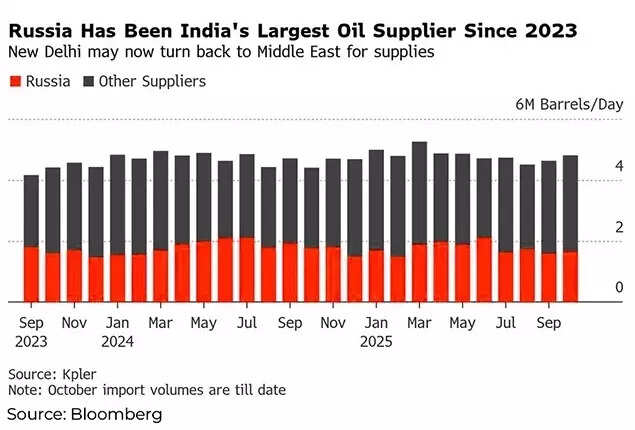

India is Russia’s largest oil supplier since 2023

The PTI report said that India’s increased oil imports from the US are seen as efforts to address trade frictions following the Donald Trump administration’s move to impose 50% tariffs on Indian exports. This shift demonstrates India’s strategic approach to maintaining energy security whilst managing its reserves and addressing US concerns about Russian oil acquisitions.

Can US oil make up for Russian crude?

Despite the increase, Russia maintains its position as India’s main crude oil supplier, making up approximately one-third of the imports. Iraq stands at the second position in supply volumes, with Saudi Arabia ranking third.Kpler’s Ritolia noted limitations to further growth in this trend saying, “While the surge underscores India’s refining flexibility and ability to capture short-term opportunities, the current rise is arbitrage-led, not structural, as longer voyage times, higher freight, and WTI’s lighter, naphtha-rich yield limits increased buying.”Ritolia emphasised the strategic significance of America’s growing share in India’s crude imports, adding: “The uptick highlights growing US-India energy ties and supports India’s broader diversification strategy, balancing supply security, economics, and geopolitical alignment.”

India is Russia’s largest oil supplier since 2023

Meanwhile, the latest sanctions imposed by Trump on Rosneft and Lukoil, Russia’s two major oil companies, could compel India and China to significantly reduce or halt their Russian oil imports.The US has set November 21 as the deadline for concluding transactions, giving organisations roughly one month to complete or terminate existing contracts with these Russian oil giants.For India, this development may necessitate that both government-owned and private oil refineries reduce their dependency on Russian crude. Currently, the refiners are analysing the OFAC notice, focusing on payment procedures and compliance requirements. They are also readying their facilities to function without Russian oil after the November 21 deadline.The combined daily oil exports from these sanctioned companies amount to 3-4 million barrels.Russian oil has fulfilled 34% of India’s crude requirements in the current year, with Rosneft and Lukoil accounting for roughly 60% of these supplies.Trump has claimed assurance from Prime Minister Narendra Modi about India stopping Russian crude oil imports. India on its part has not confirmed any such agreement between the two leaders, while showing willingness to diversify and expand its energy sources.Also Read | Sanctions shock: Trump’s new play – can it force Putin to end Ukraine war?