Amid global headwinds, FMCG cos bet on India

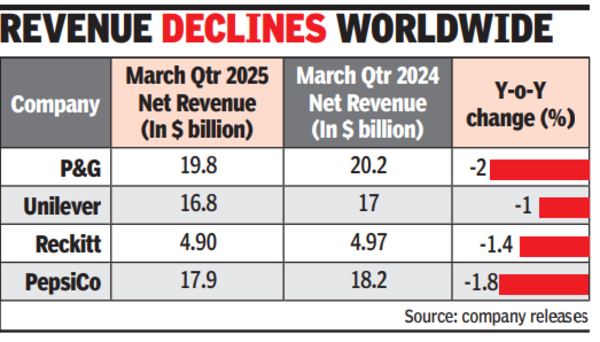

MUMBAI: For global consumer giantsbattling business headwinds posed by tariffs and sluggish consumer spending in developed regions like the US, where an uncertain macro environment has nudged people to cut back on purchases, India is emerging as one of their key growth markets.From P&G to Reckitt and PepsiCo, companies in their recent earnings calls said that consumption in India remains steady, even as some firms have lowered their full-year forecasts due to the global backdrop.

“If you look at markets like India, we are profitable, and India is driving mid-single-digit growth very nicely. We have local production on the ground, and we have R&D capability on the ground. The market gets better every time we look at it,” said Andre Schulten, chief financial officer at P&G. The firm, however, did not rule out the possibility of volatility in emerging markets going ahead in line with the macro developments unfolding globally.The maker of Pampers and Tide detergent, which expects current tariffs to have an impact of $1-$1.5 billion, said that currently the largest US tariff impacts are coming from raw and packaging materials and some finished products sourced from China.

Unilever’s acting CFO, Srinivas Phatak, said that in India, there are no new macroeconomic headwinds and that is an “important element to call out”. Govt incentives, tax relief, and lower food and oil inflation are potential consumption tailwinds that set up the market for good growth, the firm said.

“I think this is a market where we’ll be unblinking in our defense. And when we get our growth engine moving up, we know how to really make money here and how really to drive earnings ahead of growth,” said Phatak. A huge population and an increasing shift from unbranded to branded consumption help companies tap into new growth spaces in India, even though broader local consumption has been subdued over the past few quarters due to tepid urban demand.

Reckitt said that the company has seen strong volume growth in emerging markets led by China and India, particularly in the germ protection and intimate wellness spaces. “We fully expect sustained strong volume growth in China and India and in other emerging markets as we go through this year,” said CEO Kris Licht.

The company expects Europe to deliver low single-digit growth and North America to show a low single-digit decline in Q2, given the weaker consumer backdrop. “The overall macro environment has gotten weaker and has been more volatile than what we would have seen when we were guiding for the front half of the year,” said CFO Shannon Eisenhardt.

American beverage major PepsiCo, which lowered its full-year earnings forecast, said that it sees India in a “good place”, and the international business continues to be the largest “growth engine” for the company. Nestle, which expects importing Nespresso into the US and some soluble coffee to be impacted by tariffs, said it will expand in India this year.