Asian stocks today: Markets slip as Fed anxiety builds; HSI slips 1%, Nikkei sheds 16 points

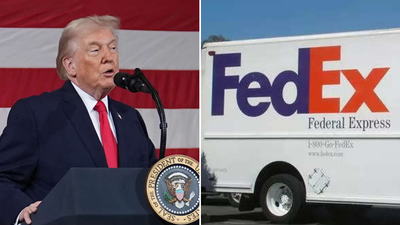

Asian equities struggled on Tuesday, weighed down by a dip on Wall Street and caution ahead of major economic decisions. Hong Kong’s HSI dipped 1.1% to 25,481, shedding 284 points. Nikkei also traded at 50,550, down 0.06% or 31 points. Shanghai and Shenzhen joined the downward rally, trimming 0.27% and 0.37% respectively, at 11:20 AM IST. China-related sentiment was subdued as investors waited to see what signals would emerge from the Central Economic Work Conference, the annual gathering of the Communist Party leadership that maps out the country’s economic priorities. In the United States, futures pointed slightly higher, following a weak finish on Monday. The S&P 500 slipped 0.3% to 6,846.51, only its second fall in 11 sessions and still within 0.6 per cent of its record peak in October. The Dow Jones Industrial Average fell 0.4% to 47,739.32 and the Nasdaq composite was marginally lower at 23,545.90. The tech sector was in focus after Nvidia rallied in extended trading. Its shares rose 2.3% after President Donald Trump said he will permit sales of the company’s H200 chip, used in artificial intelligence development, to “approved customers” in China. Trump said on Monday on his social media platform that he had notified China’s leader Xi Jinping of the decision and that “President Xi responded positively!” Nvidia had already gained 1.7% during the regular session. Markets also looked ahead to Wednesday’s Federal Reserve meeting, where the US central bank is widely expected to cut interest rates in response to weakening employment indicators. Investors are particularly focused on how much guidance policymakers will offer on rate movements for 2026, a year where expectations remain sharply divided. Inflation remains above the Fed’s 2% target and officials are split on whether price pressures or labour market risks pose the bigger threat. Commodity and currency movements remained muted early Tuesday. US benchmark crude fell 18 cents to $58.70 a barrel and Brent slipped 13 cents to $62.36. The dollar strengthened slightly to 155.96 yen from 155.92 yen and the euro rose to $1.1646 from $1.1638.