Delayed Income Tax Refunds for FY 2024-25: Key Reasons Explained | Financial Literacy News

NEW DELHI: Income tax refunds are experiencing significant delays this assessment year, with tax professionals reporting extended processing times even for routine cases. Official CBDT data shows personal income-tax refunds have dropped to Rs 88,548 crore by early November compared to Rs 1.42 lakh crore in the same period last year. According to official data updated till November 10, total refund outgo has fallen around 18% year-on-year to over Rs 2.42 lakh crore.Tax experts attribute the delays to multiple factors including late release of ITR forms, increased verification checks, and processing constraints at the Centralised Processing Centre. “Low-value refunds are being released. We have analysed and found that some wrong refunds or deductions were being claimed. So, this is a continuous process. We hope to release the remaining refunds by this month or by December,” CBDT Chairman Ravi Agrawal had said on November 17.

Why ITR refunds are delayed this year

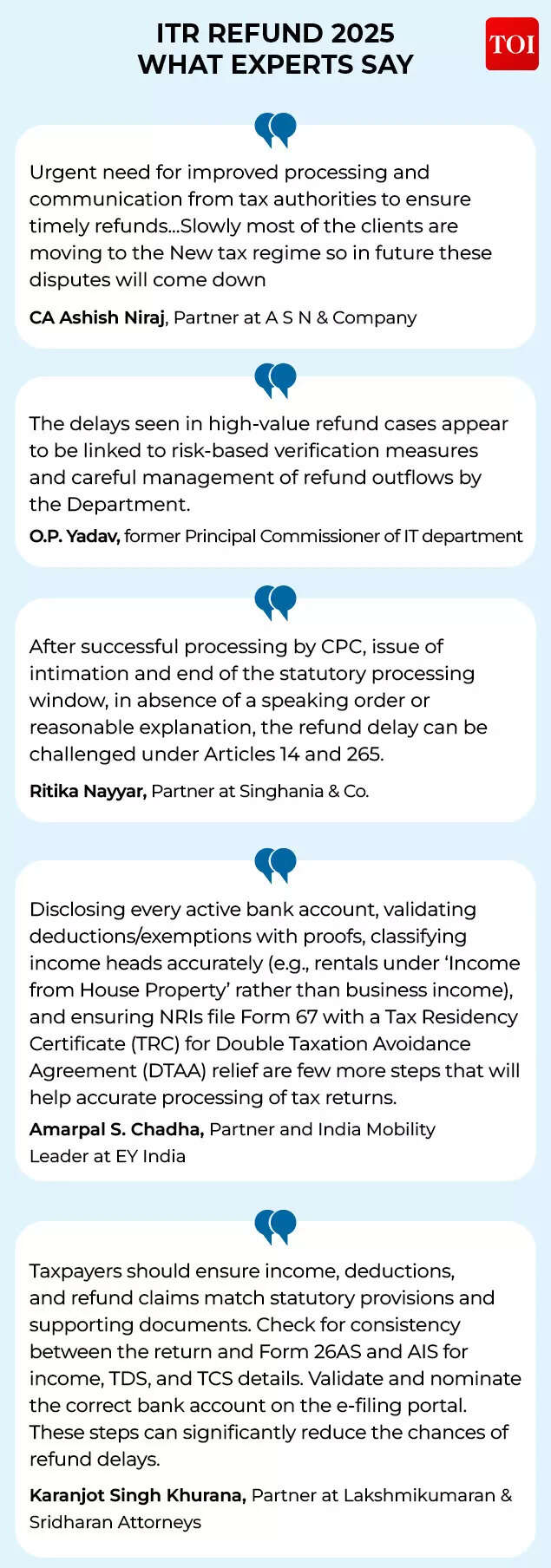

CA Ashish Niraj, Partner at A S N & Company, told TOI: “This year almost 80% of refunds above Rs 30-35,000 of our clients are delayed. Most of the refund below Rs 30,000 was processed within a month. Last year most refunds were cleared within 1-2 months of filing but this year the pendency is huge.”Karanjot Singh Khurana, Partner at Lakshmikumaran & Sridharan Attorneys says, “Refund issuance has slowed down this year, particularly for non-corporate taxpayers. According to CBDT’s monthly Direct Tax data, income tax refunds processed as of November 10, 2025, are down by about 17.72% compared to the same period last year. Notably, refunds in non-corporate cases account for a 37.72% decline within this overall drop,” Khurana told TOI.OP Yadav, former Principal Commissioner of Income Tax and now Tax Evangelist at Prosperr.io, is of the view that high-value refund returns are experiencing delays regardless of the source of income. “This includes many salary cases where large refunds arise from TDS deducted by employers under Section 192. Often, employees claim deductions and exemptions at the time of filing the ITR, instead of timely submission of Form 12BB to the employer, resulting in refund claims that may appear disproportionate and attract additional verification,” Yadav told TOI.

CA Aastha Gupta, Partner at S.K. Gulati & Associates, said there has been a significant rise in refund delays due to slow processing at the Centralised Processing Centre compared to last year.

Late form releases compound the delays

A major factor behind this year’s delays was the late release of income tax return forms. Khurana provided detailed data showing the extent of the delay. “ITR forms for AY 2025-26 were released significantly later than the previous year. For instance, the common utility for ITR 1 to 4 was released on June 11, 2025, compared to April 1, 2024, last year. ITR 2 came out on July 11, 2025, versus April 1, 2024. ITR 6 was released on August 14, 2025, against April 23, 2024,” he said.“This delay in form availability pushed back return filing and refund processing. Based on experience, refunds linked to ITR 3 and ITR 6 have faced the longest delays because these forms require more scrutiny,” Khurana added.

When salary cases trigger red flags

The delays are not confined to complex business income or capital gains cases. Niraj noted that for some clients, refunds are delayed even where only salary and interest income exists if the amount exceeds Rs 30,000-35,000. “Most Property Capital Gain cases refunds are held up even for small refunds of Rs 40,000-45,000,” he added.OP Yadav pointed out that delays are also common in NRI refund cases, particularly where refunds relate to TDS deducted on sale of property and TCS on foreign remittances when funds are repatriated abroad. “These scenarios are increasingly subject to risk-based checks before refund release,” Yadav said.When asked about additional verification, Yadav confirmed: “Particularly where refund claims appear disproportionate to the TDS, advance tax, or self-assessment tax paid. Such returns are more frequently routed through system-based risk checks, even when filed correctly.”Gupta confirmed that large TDS refund cases or returns involving loss carry-forward are being flagged more frequently. “Such cases are usually accompanied by detailed reconciliations to vet the genuineness of the TDS refunds or carry forward of losses,” she told TOI.Niraj echoed this, stating that as per different statements from department officials, there is increased verification in all high-value refunds this year. “Department has started detailed cross verification, old regime ITRs where various deductions are claimed are being checked. This year the Department had asked for Loan Account No, Policy Number, Insurer/Lender details etc in the ITR only so they have ready data available which are being verified.“However, Yadav emphasised that CPC’s jurisdiction under Section 143(1) remains limited, with adjustments generally proposed only for arithmetical errors in the return, incorrect claims apparent from the return data itself, and clear inconsistencies with information from preceding years’ ITR already on record. “Even in such cases, adjustments are made only after issuing an intimation to the taxpayer and considering their response.“The chartered accountant at A S N & Company noted that processing is pending mostly in large refund cases as the department assumes it’s an area of high risk. “TDS is deducted according to the nature of income and hence when a high TDS refund is asked, the department marks those in risky cases and checks accordingly. Carry forward of losses impacts the department’s future revenue also so the department is more vigilant on it.“

The AIS problem: When one property shows up twice

Experts are flagging that a critical systemic issue seems to have emerged around the Annual Information Statement. Niraj flagged that at many places the same income is being shown in AIS from multiple sources. “In Property Capital Gain, some data was coming from 26QB (1% TDS) Deducted by buyer, then same data was again coming as reported by Registrar of property etc.”“Now suppose someone sells property of Rs 1 crore and the entry comes from two sources, then AIS will show sale of Rs 2 crore and an unnecessary red flag will come as Taxpayer will report only One Crore as sale. Same thing happening in Share/MF Capital gains. This multiple source entries in AIS makes reconciliation tougher as the same data is coming from multiple sources,” he told TOI.The Partner at S.K. Gulati & Associates offered a nuanced take on the AIS system. “In the pre AIS/TIS era, the accuracy of the income tax return was heavily dependent on the quality and quantity of information shared by the taxpayer,” Gupta said. She explained that AIS/TIS now provides first-hand information about property sales or securities redemption, increasing return accuracy — but there’s a flip side.“Often whenever there is a transaction regarding sale of immovable property, the inputs regarding the same are received from 2 sources: 1. Office of sub divisional magistrate (SDM) and 2. Form 26AS, if the buyer has deducted tax on purchase of such property. Now, this results in double reporting of the property value thereby contradicting the capital gain computation reported in the income tax return. As tax professionals, we have seen incorrect reporting in sale values of the securities/mutual funds.““These kinds of discrepancies make us question the credibility of the information reflected in the AIS/TIS. At times, it increases our work burden, rather than simplifying the income tax return preparation and filing process,” she added.However, Gupta took a different stance on whether mismatches are driving delays. “As an income tax return professional, we file the return after proper matching of income with the values reflected in the Annual Information Statement (AIS)/ Taxpayer Information Statement (TIS)/Form 26AS. Even if there is a mismatch in the form of incorrect or extra reporting in the AIS/TIS, feedback is provided to rectify the same. So, in my opinion, the mismatches pertaining to AIS/TIS cannot be a major reason for refund delays.”Yadav explained that the power to adjust income based on Form 26AS/Form 16 mismatches during 143(1) processing was withdrawn from Assessment Year 2018-19. “Therefore, mismatches typically do not cause refund withholding at the CPC stage, unless the refund exceeds Rs 10 lakh and the ITR is proposed to be taken for scrutiny.”

Rectification requests: A tale of two realities

On whether rectification applications under Section 154 have increased, experts presented sharply contrasting views. Yadav said there has not been a notable rise in rectification requests due to auto-generated mismatch alerts or incorrect AIS entries, as the power to make additions during 143(1) processing for income appearing in Form 26AS, Form 16A, or Form 16 — but not included in the return — was withdrawn from AY 2018-19 onwards.However, CA Priyanka Jain reported a different experience: “Yes, there has been a noticeable increase in the number of rectification applications under section 154, primarily triggered by mismatches between the taxpayer’s return data and the information reflected in the AIS or Form 26AS. The CPC’s automated processing under section 143(1) now picks up even minor discrepancies — such as unreported interest income, mismatched capital gain figures, or TDS credits not properly reflected — which often lead to adjustments in the intimation.“Jain cited timing issues as a common problem: “For example – AIS includes dividends declared but not actually received in the financial year (due to record date vs payment date differences). CPC adds them, inflating taxable income. As a result, taxpayers and professionals are increasingly having to file section 154 applications to seek correction of such apparent mistakes, especially where the adjustment is mechanical and not a subject of interpretation.“Gupta confirmed: “In such cases, we file rectified returns under Sec. 154 of the Income Tax Act, 1961 with the correct details as pointed in the notice.”

Legal concerns mount over ‘speaking order’ requirement

Ritika Nayyar, Partner at Singhania & Co, raised serious procedural concerns about refunds being held without proper legal backing. “This seems to be the case. Even after the successful processing of returns by CPC, refund payments are taking time, despite of no official or proper reasoning recorded by the AO, sometimes on the pretext that they have internal administrative orders for deferring them once all verifications done, which is contrary to the statutory safeguards and judicial requirements for a speaking order,” Nayyar told TOI.On when delays become legally challengable, she said: “After successful processing by CPC, issue of intimation and end of the statutory processing window, in absence of a speaking order or reasonable explanation, the refund delay can be challenged under Articles 14 and 265.”Nayyar argued that interest under Section 244A alone is insufficient. “Considering unlawful/unjustified delays, interest u/s 244A alone is certainly not a sufficient resolution, enough to compensate for the delays, therefore courts are justified in awarding additional compensation — including ‘interest on interest’ — where refunds are withheld without statutory backing.”On procedural safeguards, she recommended: “The Dept must implement a standard timebound resolution process. In case of discrepancies in such forms, immediate notices should be issued within 15 days of processing seeking responses, in say, another 15-20 days. This will give taxpayers an opportunity of being heard after which a speaking order must be passed. There must be strict timelines within which this process should be completed.“The Partner at Singhania & Co linked the delays to structural changes: “More filters mean more checks which eventually means longer refund processing time, because all returns must clear all the criteria to be considered successfully processed and duly and legally be eligible to claim their refunds.”

Budget pressures and backend overload

Yadav believes that backend strain is affecting high-value refund processing. “There are indications that backend strain may be affecting the processing of high-value refunds at CPC. One contributing factor could be the authorities’ management of refund outflow in light of broader budget-collection targets,” Yadav said.He cited CBDT data showing that as of 10 November 2025, personal income-tax refunds issued to date amount to Rs 88,548.10 crore, significantly lower than the Rs 1.42 lakh crore issued in the same period last year — a decline of roughly 38%. “While this data does not disclose how many refund claims remain pending, such a substantial drop suggests a strong possibility of delays particularly affecting high-value refund cases.“The Partner at S.K. Gulati & Associates linked the strain to sheer volume and deadline extensions. “More than 8 crore returns have been filed for AY 25-26 (FY 24-25) till November end. We still have 10 more days to go for audit related income tax returns as their deadline was extended from 31st October, 2025 to 10th December, 2025,” Gupta told TOI.“Owing to the new changes in different income tax return forms, the original deadlines were stretched resulting in delay in all the steps related to return processing. So that’s why even an income tax return which was processed as per normal timeline, has been extended. And returns with refunds or defects are taking more than normal time for processing at the CPC level.”Gupta cited increasing frustration among taxpayers. “We are not able to provide a justified reason for delay in processing and hence, crediting the income tax refunds, especially when this process was streamlined in the previous financial years. We have also raised grievances with the income tax portal to highlight this issue, but in vain. No proper resolution is being provided by the income tax portal.”However, Yadav noted that formal grievances have not spiked significantly because under Section 143(1), CPC has time to process returns filed during FY 2025-26 up to 31 December 2026. “Therefore, while delays in high-value refund cases have led to some anxiety among taxpayers, this has not yet resulted in a significant increase in formal grievances, as the current processing status is still within the legally permissible timeframe.“

Bank issues mostly resolved, but tracking gaps remain

On technical glitches, Yadav said bank-related issues are generally not a major reason for refund delays this year, as the e-filing system does not allow submission of the return for AY 2025-26 unless the refund bank account is pre-validated. The chartered accountant at A S N & Company confirmed that in their clients, only one case was of a failed account due to IFSC Code mismatch due to banks merger, which was corrected and the refund came through.Gupta offered additional context: “Bank related issues like KYC mismatch, non linkage of PAN & Aadhaar number, failed account pre-validation etc. were common causes of delay in crediting of income tax refund in the selected bank account earlier as well; they cannot be considered as a specific reasons for delay in the current year. In fact, whenever there is a refund delay due to a bank related issue, the taxpayer gets the intimation so that it can be corrected and the refund can be duly credited.“On system-generated notices for minor differences, she noted: “This is a subjective area. In my experience, the cause of system generated notices varies from case to case. It cannot be considered as a major reason for triggering a refund delay.”On tracking tools, Niraj advocated for better transparency: “There should be real time refund sub-process wise tracking available on Income Tax Portal. This would be of great help as clients can check status themselves and estimate the timeframe. Presently only ‘Successfully e-verified’ status is shown, in cases where refunds are delayed due to non-processing.”Khurana noted that while a tracker exists, it’s inadequate. “The e-filing portal already offers a refund status tracker under Services — Know Your Refund Status. However, the tracker shows the status only after the return is processed and refund is determined. It does not provide real-time information on the timelines for processing of return and determination of refund. A more comprehensive, real-time tracker which provides tentative timelines for processing of return and determination of refunds would greatly improve transparency and reduce taxpayer anxiety,” he told TOI.yadav took a slightly different view, noting that taxpayers already have access to a real-time refund status facility through the e-Filing Portal. “Given this existing functionality, a separate dashboard may not add substantial incremental value at this stage.”

What taxpayers must do now

Amarpal S. Chadha, Partner and India Mobility Leader at EY India, outlined comprehensive precautions. “Many taxpayers still encounter avoidable pitfalls that delay processing of returns and refunds. Some of the key precautions that will help faster processing include selecting the correct ITR form based on income sources, meticulously reconciling details in the AIS, TIS, Form 26AS to eliminate discrepancies and reporting all exempt incomes and losses often overlooked by taxpayers.“Chadha added: “Additionally, disclosing every active bank account (not just the refund-linked one), validating deductions/exemptions with proper proofs, classifying income heads accurately (e.g., rentals under ‘Income from House Property’ rather than business income), and ensuring NRIs file Form 67 with a Tax Residency Certificate (TRC) for Double Taxation Avoidance Agreement (DTAA) relief are few more steps that will help accurate processing of tax returns. Finally, complete e-verification within 30 days is crucial to prevent invalidation and processing halts.”Khurana emphasised basic precautions: “Taxpayers should ensure income, deductions, and refund claims match statutory provisions and supporting documents. Check for consistency between the return and Form 26AS and AIS for income, TDS, and TCS details. Validate and nominate the correct bank account on the e-filing portal. These steps can significantly reduce the chances of refund delays.”Yadav emphasised that refund delays are most often triggered by procedural lapses rather than system issues, recommending taxpayers ensure complete and correct reporting of income, avoid claiming incorrect or exaggerated deductions, match reported taxes with AIS/Form 26AS/Form 16, and respond promptly to notices.

Is this the new normal?

On whether this pattern is temporary, experts offered mixed views. Khurana suggested this year’s issues were largely circumstantial. “This year’s delays were mainly due to significant changes in income-tax forms, especially after amendments to capital gains provisions introduced on July 23, 2024. Updating these forms took time, which pushed back return filing and refund processing,” he told TOI.“The good news is that the Finance Act 2025 did not bring major changes, so we expect next year to be smoother. However, with the Income-tax Act, 2025, set to take effect from April 1, 2026, the department will need to ensure timely release of new forms to avoid similar issues in FY 2026-27,” Khurana added.Yadav, however, suggested the delays may be more structural. “The current trend suggests more than just a temporary slowdown. The delays seen in high-value refund cases appear to be linked to risk-based verification measures and careful management of refund outflows by the Department. If these compliance-focused and revenue-balancing approaches continue, similar processing patterns may well persist in the coming years — especially for cases involving large refunds.“Niraj offered a more optimistic view for the longer term: “Slowly most of the clients are moving to the New tax regime so in future these disputes will come down.”