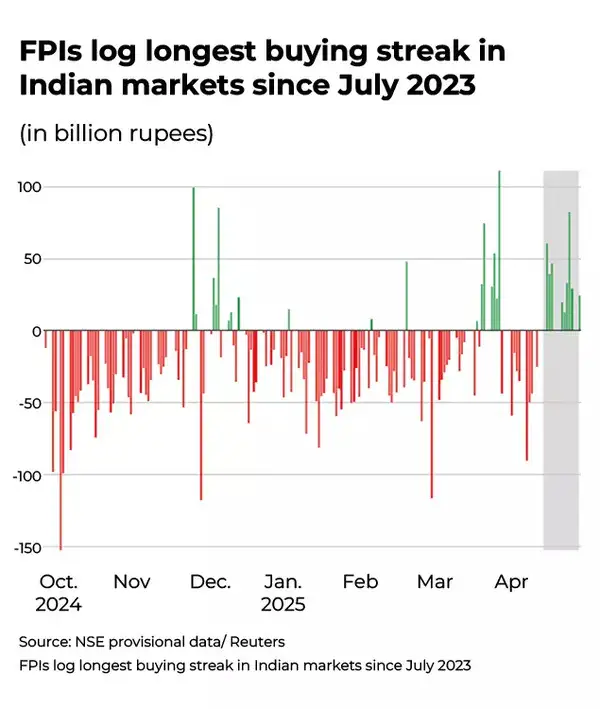

Foreign investors back with $4.11 billion in Indian equities! FPIs extend longest buying spree since July 2023

Foreign investorsmaintained their longest purchasing streak since July 2023 on Monday, driven by optimistic prospects regarding US trade agreements, attractive company valuations, and India’s stability amidst global uncertainties.This trend persisted despite tensions between India and Pakistan.

Foreign portfolio investors (FPIs) invested approximately $4.11 billion in Indian stocks across nine consecutive sessions, resulting in a 6.6% increase in the benchmark Nifty 50 index during this period.

G Chokkalingam, founder and head of research at Equinomics Research told Reuters that international investors are returning to Indian stock markets because India appears less susceptible to global trade conflicts compared to the US and China. He also noted that India is expected to maintain its position as the fastest-growing major economy in fiscal year 2026.

FPIs in Indian stock markets

The stock markets remained resilient, dismissing concerns about potential escalation of India-Pakistan tensions following the terrorist attack in Kashmir last week, which had initially affected investor confidence.

Market analysts indicate that anticipated U.S.-India trade agreements could lead to increased portfolio investments in the immediate future.

On Monday, U.S. Treasury Secretary Scott Bessent noted that whilst numerous trading partners presented “very good” tariff proposals, an agreement with India would likely be amongst the first to be finalised, possibly within the week.

Foreign investors’ attention towards Indian equities is attributed to favourable large-cap valuations and robust performance from key companies like Reliance Industries, alongside strategic fund movements between China, India, and the United States, according to Kranthi Bathini of Wealthmills Securities.

Also Read | Gold prices hit Rs 1 lakh! What’s the outlook for gold and should you buy or sell the yellow metal? Explained

This recent foreign investment follows a period of significant withdrawals totalling $25.3 billion from October 2024 to March 2025, triggered by elevated valuations, declining earnings, growth concerns and global trade uncertainties.

As of Monday’s closing, the Nifty index stood 7.4% lower than its peak reached on September 27, 2024.