India’s bold, but difficult mission! Why countering China’s rare earth magnets’ monopoly won’t be easy – major roadblocks ahead

China dominates the world’s rare earth metals and minerals supply – and it’s a fact that the world’s second largest economy is exploiting to the fullest, increasingly so in view of the tariff war unleashed by US President Donald Trump.In the global context, China dominates rare earth production with 69% share. The United States contributes 12%, whilst Myanmar holds 11% and Australia maintains 5%. Given Myanmar’s strong economic and political alignment with China, their combined control extends to 80% of worldwide production. Japan has successfully reduced its Chinese dependence to 60% through long-term agreements with Australia’s Lynas Corporation, shifting from its previous near-total reliance on Chinese supplies.India’s neighbour has also blocked supply of rare earth magnets to India, a situation that could hit the Indian industry. Acknowledging its extreme dependence on China, India has over the years moved to work out a solution – both through plans for domestic production and tie-ups with other countries.But it’s a typical case of a task being easier said than done.

India’s Rare Earth Roadblocks

As India embarks on a plan for domestic production of rare earth magnets, it is looking to enter a sophisticated technological arena currently controlled by a select few international manufacturers. The initiative, supported by government funding and strategic planning, is ambitious yet complex. Take the case of neodymium magnets – despite their small size, they are crucial components powering contemporary technology – from EVs and wind energy systems to mobile devices and defence equipment.Also Read | Reducing acute dependence, countering China’s near monopoly: India readies Rs 5,000 crore scheme for rare earth mineralsThe manufacturing process requires specific combinations of light rare earth elements including neodymium and praseodymium, along with trace amounts of heavy rare earths such as dysprosium and terbium – materials that present significant challenges in both procurement and processing.The development of an end-to-end domestic supply chain for rare earth magnets in India faces significant challenges as listed in an ET report, and finding solutions to these obstacles presents considerable difficulty.

Biggest Hurdle: Where are the mineral deposits?

India currently produces approximately 2900 tons of rare earths, consisting entirely of light rare earths, with a notable absence of essential heavy rare earths.India’s primary rare earth deposits are found in coastal beach sands, with typically low mineral content. A recent finding in a Gujarat tribal village was finally found to be ultra-fine, micron-sized particles, rendering extraction both technically challenging and financially unfeasible. The Geological Survey of India (GSI) has redirected its exploration efforts inland, particularly towards Rajasthan, though no substantial deposits of magnet-grade rare earths have been verified yet, the ET report said.

- GSI has investigated 51 locations in the past four years, with 16 surveys conducted in FY25, increasing from 10 in FY22.

- All these sites are situated in Rajasthan, indicating a strategic move away from coastal regions.

- The outcomes have been limited, with only three locations – examined in FY22 and FY23 – identified for neodymium and related rare earths including dysprosium.

- These sites remain at the G4 exploration phase (preliminary reconnaissance).

- Ladi Ka Bas in Rajasthan is the sole site progressed to G2 level, though GSI has not explicitly confirmed the presence of magnet metals there.

Who will extract the rare earths?

IREL (India) Ltd, operating under the Department of Atomic Energy (DAE), is the exclusive producer of rare earth elements in India. This public sector enterprise maintains the country’s monopoly in rare earth production.The organisation extracts rare earths as a secondary product whilst mining beach sand, specifically from monazite, which is classified as a radioactive mineral and falls under atomic energy regulations.Also Read | China plays hardball! After choking rare earth magnets supply, China blocks important agriculture-related shipments to India; continues exports to othersTo establish an effective magnet supply chain, India requires comprehensive integration across various sectors including mining, separation, refining, materials science and magnet production. Currently, the country lacks these capabilities at a substantial scale.Reports indicate that the Department of Atomic Energy and Ministry of Heavy Industries (MHI) are in the final stages of developing a production-linked incentive (PLI) scheme for rare earth magnets. The initiative, allocated Rs 1,000 crore, targets domestic production of 1,500 tonnes of rare earth magnets. This amount represents merely 5% of India’s projected requirement of 30,000 tonnes. IREL’s contribution will comprise approximately 500 tonnes of raw materials.IREL’s core business remains focused on ilmenite, which generates substantial revenue through titanium dioxide pigment production for paints, alongside other industrial minerals including rutile, zircon, and sillimanite. Their involvement in rare earth elements, particularly magnet metals, is currently at a nascent stage, despite increased attention.In collaboration with BARC (Bhabha Atomic Research Centre), IREL has begun developing samarium-cobalt magnets for defence sector applications. The strategic significance of this initiative was highlighted when Prime Minister Modi inaugurated a pilot facility. Defence laboratories are currently evaluating sample deliveries.The company’s annual report explicitly acknowledges a significant challenge in its Opportunities and Threats section: “Availability of limited processing technologies and knowhow on rare earths other than China.”Also Read | US plans ‘economic bunker buster’ bill: Will Donald Trump impose 500% tariff on countries importing oil from Russia? How it may impact IndiaNevertheless, this limitation could potentially transform into an advantage. Once IREL masters the required technology, it could establish itself as an alternative supplier to China, positioning India as a viable secondary source in the global supply chain.India is also seeking international sources to address its deficit. IREL, following governmental guidance, is now exploring rare earth resources in Oman, Vietnam, Sri Lanka, and Bangladesh. Additionally, India has established a strategic partnership with the United States to minimise Chinese reliance.

India’s Rare Earth Production

- India holds approximately 6% of worldwide rare earth deposits, yet its production remains stagnant. According to Statista, the country’s output stayed constant at 2,900 tonnes from 2012 to 2024, representing merely 1% of worldwide production.

- India primarily sources its rare earth elements from monazite-containing coastal sands, which yield minimal returns.

- The Orissa Sands Complex, IREL’s principal facility, processes 7.5 million tonnes of sand annually, producing 600,000 tonnes of industrial minerals. Rare earth elements comprise only a small portion, with valuable magnet metals being scarce. The site lacks heavy rare earth elements such as dysprosium and terbium.

- IREL maintains additional mining operations in Kerala and Tamil Nadu, with a combined annual rare earth production of 2,900 tonnes, requiring the processing of 10 million tonnes of sand. The majority consists of light rare earth elements including cerium and lanthanum, along with magnet materials such as neodymium and praseodymium.

- IREL has faced numerous operational constraints preventing expansion of rare earth production during the last ten years, including challenges in securing fresh mining permits, prolonged environmental approvals, limitations due to CRZ guidelines, forestry permissions, and residential settlements.

- The organisation has located valuable deposits in Odisha’s Puri district, though the status of mining authorisations remains uncertain. Local authorities might hesitate to permit mining activities, considering the significance of coastal areas to the region.

Price vs Economic Viability Challenge

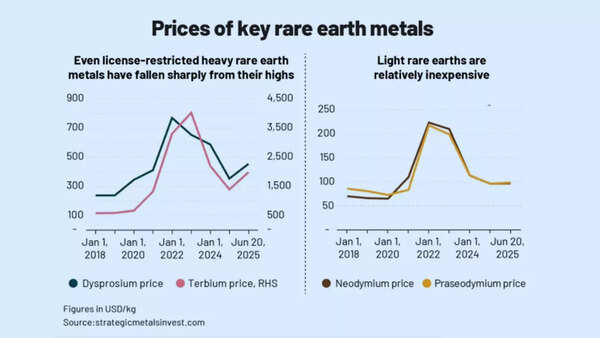

The prices of rare earth metals have significantly declined in recent months, despite a slight recovery, they continue to remain low. This can be understood with the example of Lynas Corporation, the largest producer of neodymium magnets and materials outside China, which reported a substantial decline in profits.

Prices of key rare earth metals

Their H1 FY25 earnings showed only $5.9 million in profit from $254 million revenue, a sharp decrease from $157 million profits in H1 FY22.

- India’s import statistics reflect this market trend. The country’s rare earth magnet imports increased by 88% to 53,700 tonnes in FY25 compared to FY24.

- However, the value of these imports only grew by 5%, reaching Rs 1,744 crore, suggesting that despite their essential nature, rare earth magnets remain relatively inexpensive.

- Hence, the economic viability of extracting rare earths presents a significant challenge.

- The scenario where India allocates Rs 1,000 crore to subsidise 1,500 tonnes of magnet production appears financially unsound, particularly when importing 53,700 tonnes costs just Rs 1,744 crore, the ET report said.

- This investment would only become viable if domestic production increases substantially and achieves cost-effective manufacturing processes.

- The financial challenges are highlighted in IREL’s FY24 annual report, which states: “The sharp price reduction in rare earth metals and the source of IREL’s rare earths vis-à-vis other major producers further complicates matters.”

What’s the way ahead?

India’s significant increase in magnet imports during FY25 appears to be a strategic accumulation in anticipation of possible Chinese export limitations. This proactive approach explains the relatively calm response from various Indian industrial sectors, as they have likely secured sufficient inventory to manage potential supply constraints, the report said.India’s rare earth situation reflects limitations in technical capacity and economic viability rather than lack of intention. The country has long acknowledged its Chinese dependency and sought independence. Achieving a competitive rare earth magnet sector requires persistent exploration, advanced technical collaborations, efficient regulations and substantial governmental backing.The country has reduced rare earth mining royalty to 1% and initiated auctions in 2023. Survey activities continue to increase. This endeavour has only just started and will demand sustained dedication over the coming years. We have a long way to go!Also Read | India bleeds Pakistan dry: Water at ‘dead’ levels in Pakistan’s dams; bigger Indus river plans in the works – top points to know