NPA sale to ARCs: Rs 20k crore year-end bonanza for banks

MUMBAI: India’s public sector banks are set to enjoy a year-end boost to their profits. A new directive from the Reserve Bank of India (RBI) allows them to book profits on security receipts (SRs) received against bad loans that have been fully written off and sold to asset reconstruction companies (ARCs). Significantly, the move is expected to add as much as Rs 20,000 crore to banks’ earnings.

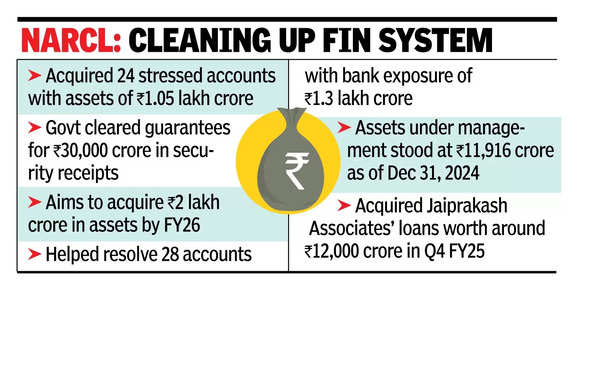

At the heart of the decision is the National Asset Reconstruction Company (NARCL), a state-backed “bad bank” tasked with cleaning up the financial system. Lenders, mainly public sector banks, had offloaded non-performing assets worth around Rs 24,000 crore to NARCL.

In return, they received 15% of the value in cash and the rest in SRs backed by a government guarantee. Unlike SRs issued by private ARCs, these instruments come with an implicit assurance of full recovery. Yet, until now, the RBI had barred banks from recognizing the underlying value of these SRs until they received cash. The latest circular changes that.

If a bad loan is sold at a price higher than its net book value, the excess amount can now be recognized as profit immediately, provided the deal involves only cash and government-backed SRs.

The change applies to both past and future transactions. However, SRs must still be deducted from core capital, and banks cannot pay dividends from them.

“Government Guaranteed SRs are a class in themselves and needed a differential treatment in the books of bank/financial institutions in respect of accounting at the time of transfer of NPAs and continuing valuation thereafter,” said Hari Hara Mishra, CEO, Association of ARCs in India. He added that this rationalisation will help banks front-end profit booking of surplus over net book value of assets transferred and improve liquidity in the financial system by unlocking accumulated provisions held in respect of these loans.

Bankers welcomed the move, arguing that it merely acknowledges an inevitable payout. Since NARCL’s SRs are government-backed, the risk of default is virtually non-existent.