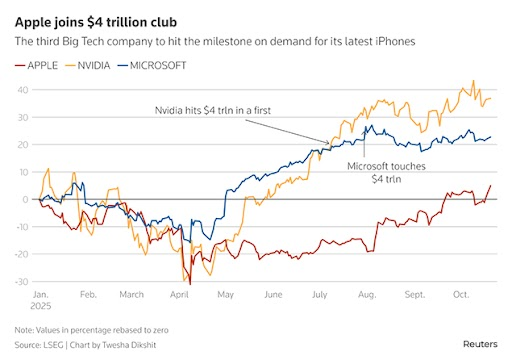

Powered by iPhones, not AI! How Apple becomes third company to join $4 trillion club — explained in charts

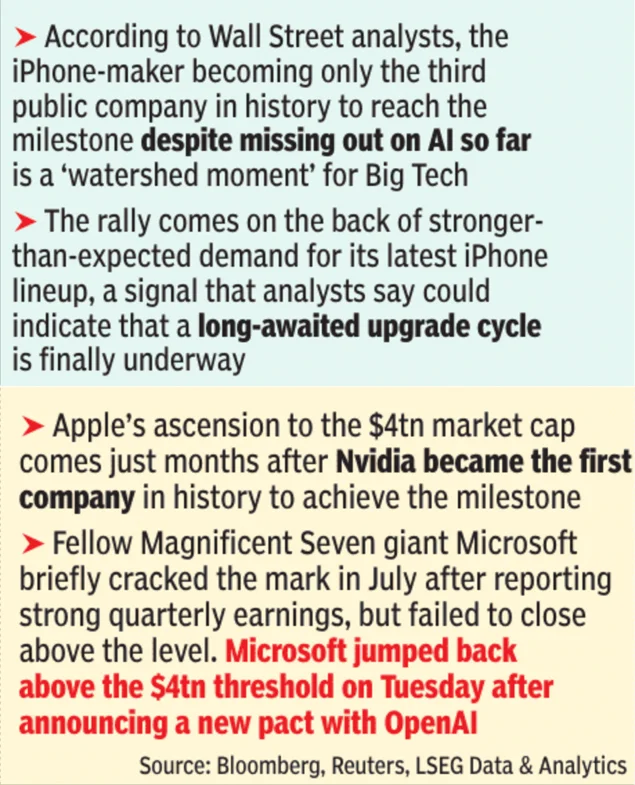

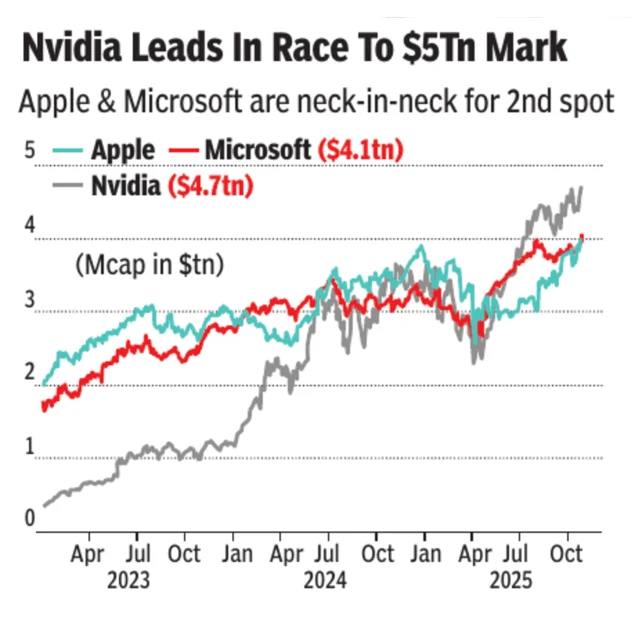

Apple became the third company in history to reach a $4 trillion market capitalisation, driven by soaring iPhone sales and renewed investor confidence — not by artificial intelligence. Shares of the Cupertino-based company have rallied more than 56% since April, adding about $1.4 trillion in value. Analysts say the comeback reflects not just a strong product cycle, but also a symbolic moment for Big Tech, as Apple reaches new heights despite lagging behind peers like Microsoft and Nvidia in the AI race.According to Wall Street analysts, the iPhone-maker becoming only the third public company marks a “watershed moment” for Big Tech.

$4 trillion milestone — Fueled by iPhone, not AI

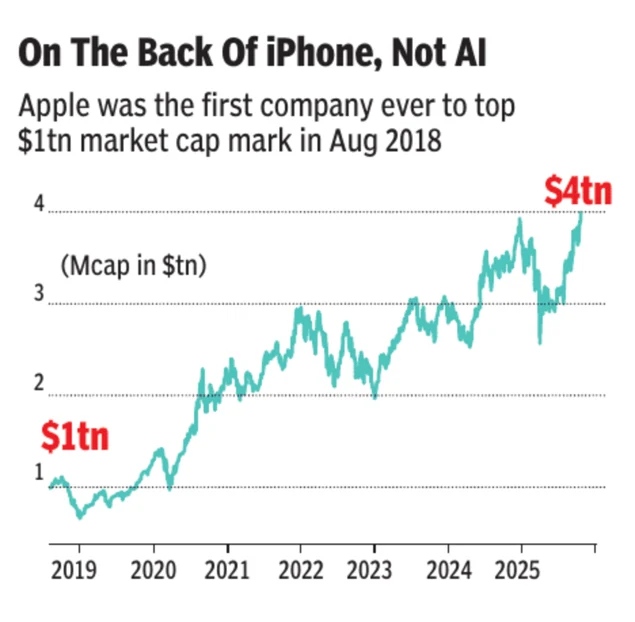

Apple briefly crossed the $4 trillion mark on Tuesday after its stock touched $269.89, before closing the day slightly lower at $3.992 trillion in value. The company’s shares have jumped around 13% since the launch of its new iPhone lineup on September 9, marking a major turnaround for a stock that struggled earlier this year.“The iPhone accounts for over half of Apple’s profit and revenue and the more phones they can get into the hands of people, the more they can drive people into their ecosystem,” Chris Zaccarelli, chief investment officer at Northlight Asset Management told Reuters.The milestone is especially significant as Apple becomes the third public company ever to cross the $4 trillion mark, following Nvidia and Microsoft, both of which rode the global AI wave to record valuations earlier this year.

The iPhone comeback — The Apple way

While Apple had a sluggish start to 2025, concerns about competition in China and rising US tariffs weighing on profits have eased. The company managed to absorb higher manufacturing costs across its Asian hubs and still generate strong demand for its latest smartphones, the iPhone 17 series and the iPhone Air.The new models quickly won back customers from Beijing to Moscow within weeks of launch, even as the company dealt with high tariff costs. Analysts said the iPhone Air’s slim design and advanced camera helped Apple regain ground against rivals like Samsung Electronics.

According to data from Counterpoint Research, iPhone 17 sales outperformed the previous model by 14% in both the US and China. Brokerage Evercore ISI expects this strong demand to help Apple beat market expectations for the September quarter and deliver upbeat guidance for the December period.However, Apple’s slow approach to artificial intelligence has raised concerns that it might miss out on one of tech’s biggest growth opportunities. Several senior AI executives have left Apple for Meta, adding to uncertainty around its long-term AI plans, Reuters reported.

‘Lack of well-understood artificial intelligence’

Unlike its rivals, Apple has been slow to join the AI race that has powered companies like Microsoft, Google, and Nvidia to record valuations. Its Apple Intelligence suite, including ChatGPT integration and an upgraded version of Siri, has been delayed until next year.Reports suggest Apple is exploring AI tie-ups with Alphabet’s Gemini, Anthropic, and OpenAI, but its cautious rollout has raised eyebrows on Wall Street.“The lack of a well-understood artificial intelligence strategy is clearly one of the things that is an overhang for the stock. If they could figure out how to incorporate artificial intelligence in a way that would excite consumers and the market, you’d see a whole different company,” Zaccarelli told Reuters.Apple’s slower pace in AI has even led to the exit of several senior AI executives to Meta, prompting questions about how the company plans to compete in a world increasingly shaped by artificial intelligence.Still, the iPhone’s strong showing has reinforced that Apple’s core ecosystem — hardware, services, and customer loyalty, remains its biggest strength.

Apple vs Microsoft vs Nvidia — The trillion-dollar race

Apple’s $4 trillion moment comes just months after Nvidia became the world’s first $5 trillion company, a result of skyrocketing demand for AI chips and data-center infrastructure. Earlier on Tuesday, Microsoft briefly crossed the $4 trillion mark again after unveiling a new AI collaboration with OpenAI. The competition among these tech giants underscores how different growth engines, AI for some, hardware for others, are reshaping global markets.Currently, Nvidia leads the valuation race with a market cap nearing $5.05 trillion, while Apple and Microsoft are neck-and-neck for the second spot.Apple’s milestone comes just months after Nvidia became the first company to cross the $4 trillion mark, with Microsoft briefly touching $4.1 trillion earlier this year following a new pact with OpenAI. The rebound signals what experts call a long-awaited iPhone upgrade cycle, reinforcing Apple’s dominance!Apple was the first company in history to reach a $1 trillion valuation in 2018, and just seven years later, it has quadrupled that figure. As Apple prepares to report its fourth-quarter results on October 30, investors are watching closely to see whether this iPhone-driven rally can sustain momentum, or if the company’s next leap will finally come from AI.