SIPs hit new high in June as D-Street uncertainty eases

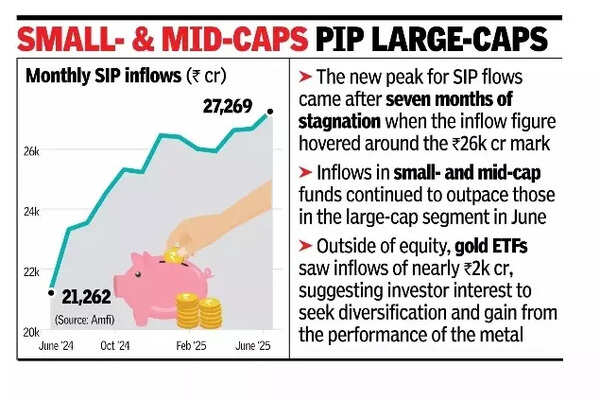

MUMBAI: After a few months of flat growth in inflows by retail investors through SIPs in mutual fund schemes, the northward movement is back. In June, gross inflows through SIPs in MFs – an investment segment within the MF industry that is dominated almost entirely by retail investors – touched a new all-time peak at Rs 27,269 crore.This showed a monthly jump of 2.2%, data released by industry body Amfi for June showed. The month’s growth number and the new peak in terms of gross flows came after seven months of stagnation when every month the inflow figure hovered around the Rs 26K mark.The month’s figure also showed that the total assets under management (AUM) of the fund industry also scaled a new peak, at Rs 74.8 lakh crore.According to Amfi chief Venkat Chalasani, these growth numbers – in monthly SIP inflows and the total industry AUM – continued to be powered by strong retail participation. “The number of contributing SIP accounts also touched an all-time high of 8.64 crore, underlining the growing trust in mutual funds as a disciplined investment vehicle,” he said.Chalasani also pointed out that net inflows into equity funds during June was at Rs 23,587 crore, which was the 52nd consecutive month of positive flows. “While market volatility has made some investors cautious, we’re also witnessing a healthy shift towards hybrid and arbitrage funds, a trend that shows maturing investor behaviour and a preference for balanced risk strategies in uncertain times.”

June data for the fund industry also showed that SIP AUM for the industry was at Rs 15.3 lakh crore, translating to 20.6% of the total MF industry AUM, up from 20.2% in May. “The continued strength of SIPs underscores disciplined participation from retail investors. The inflows recorded in June may signify a turning point, reflecting enduring structural confidence in Indian equities and a growing risk appetite,” Samco MF CEO Viraj Gandhi said.He also said that in June, inflows in small- and mid-cap funds continued to outpace those in large-cap segment. Outside of equity, “gold ETFs saw inflows of nearly Rs 2,000 crore, suggesting investor interest to seek both diversification and also gain from the performance of the metal,” said Anand Vardarajan, chief business officer, Tata MF.